Victoria B.C real estate

Victoria B.C Real Estate: A Guide for Buyers and Mortgage Information

Victoria, British Columbia, is known for its stunning landscapes, vibrant culture, and thriving real estate market. Whether you are a first-time buyer or looking to invest in a new property, navigating the Victoria B.C real estate market can be an exciting but overwhelming experience. In this blog post, we will explore some important aspects to consider when purchasing a property in Victoria, as well as provide valuable information on mortgages.

For many buyers, location is a key factor. Victoria offers a variety of desirable neighborhoods, each with its own charm and amenities. From the historic downtown area with its bustling shops and restaurants to the family-friendly suburbs with excellent schools, Victoria has something for everyone. Before starting your property search, it's important to research and visit different neighborhoods to find the one that best suits your lifestyle and preferences.

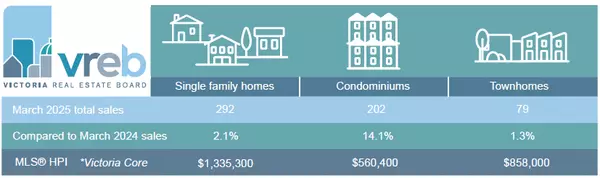

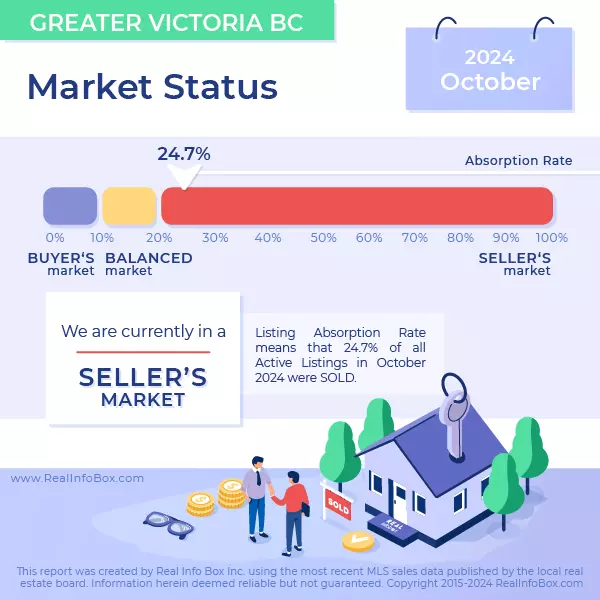

Once you have identified your desired location, it's time to consider your budget. Determining your financial capacity is crucial, as it will dictate the type of property you can afford. In Victoria, housing prices can vary significantly depending on factors such as location, size, and condition. Consulting a real estate agent or mortgage advisor can help you understand your borrowing power and provide guidance on finding properties within your budget range.

Speaking of mortgages, it's essential to have a good understanding of the different types of mortgages available. Fixed-rate mortgages, adjustable-rate mortgages, and variable-rate mortgages are just a few examples. Each has its own advantages and considerations, such as interest rate stability or potential savings. Consulting with a mortgage specialist will help you navigate through the complexities of mortgages and make an informed decision.

When it comes to the length of the mortgage, it's important to consider your long-term financial goals. While a longer mortgage term may result in lower monthly payments, it also means paying more interest over time. Conversely, a shorter mortgage term may have higher monthly payments, but it allows you to pay off your property faster and potentially save on interest. Again, working closely with a mortgage advisor will help you find the right balance for your financial situation.

In conclusion, buying a property in Victoria, B.C, requires careful consideration of location, budget, and mortgage options. With the help of experienced professionals, you can navigate the real estate market with confidence and find your dream home in this beautiful city. Happy house hunting!

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "