30-year amortizations will be available for all first-time home buyers

Today, the federal government announced some of the most impactful changes to mortgage qualification criteria since 2012. As of December 15, 2024, 30-year amortizations will be available for all first-time home buyers, as well as all new construction purchases. The maximum home purchase price for insured mortgages has also been increased to $1.5 million.

Together, these two changes should materially improve affordability for first-time buyers. Here’s how they may impact you:

(Psst: Big News! The lowest five-year fixed rate available in Canada right now is 4.09%, offered exclusively by Ratehub.ca and if your mortgage is coming up for renewal, we have exciting new switch promos you should ask your Ratehub.ca agent about.)

Together, these two changes should materially improve affordability for first-time buyers. Here’s how they may impact you:

(Psst: Big News! The lowest five-year fixed rate available in Canada right now is 4.09%, offered exclusively by Ratehub.ca and if your mortgage is coming up for renewal, we have exciting new switch promos you should ask your Ratehub.ca agent about.)

- 30-year amortizations will lower payments: Spreading your amortization out over a 30-year period compared to 25 will lower the amount you’ll pay on your mortgage on a monthly basis. This helps improve cash flow for borrowers, as well as debt ratios – all of which are helpful when qualifying for a mortgage. Many lenders also offer more competitive mortgage rates to insured borrowers.

Categories

Recent Posts

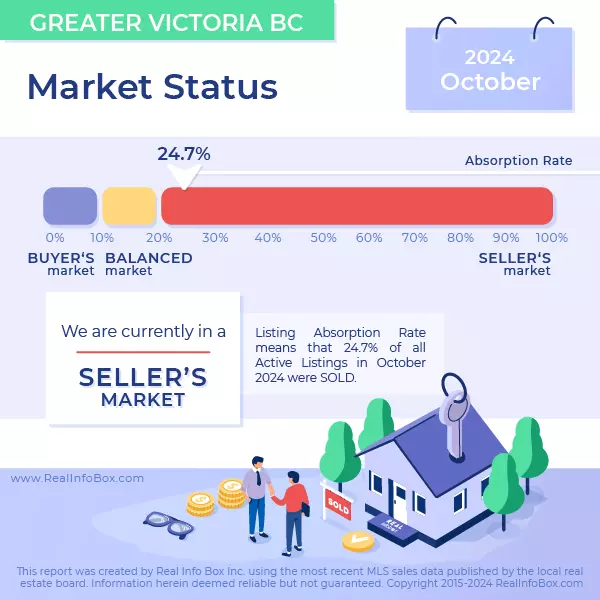

A warm start to winter sales in the Victoria real estate market

Charming Family Home in Langford: 954 Preston Way

Luxurious Modern Living: Brand New Half Duplex in Southport, Langford, BC

Charming Historic Home with Modern Updates: 521 Third Ave, Ladysmith, BC

Charming 2-Bedroom Condo in Victoria: Perfect for Urban Living and Investment

Charming Family Home with In-Law Suite in Langford: A Must-See Property!

Victoria market exceeds expectations but remains balanced

Incentives First-Time Home Buyers in BC Should Know..

The Difference Between Regular and Bare Land Stratas

The Victoria Housing Market: Trends and Insights

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "